The cost of nursing home care in the U.S. is incredibly high. In 2023, the average cost for a semi-private room in a nursing home is around $8,669 per month, while a private room can cost as much as $9,733. Given that many seniors live on fixed incomes, often from Social Security, paying for these expenses can seem impossible. Most people simply can’t afford to pay out of pocket and turn to insurance for help.

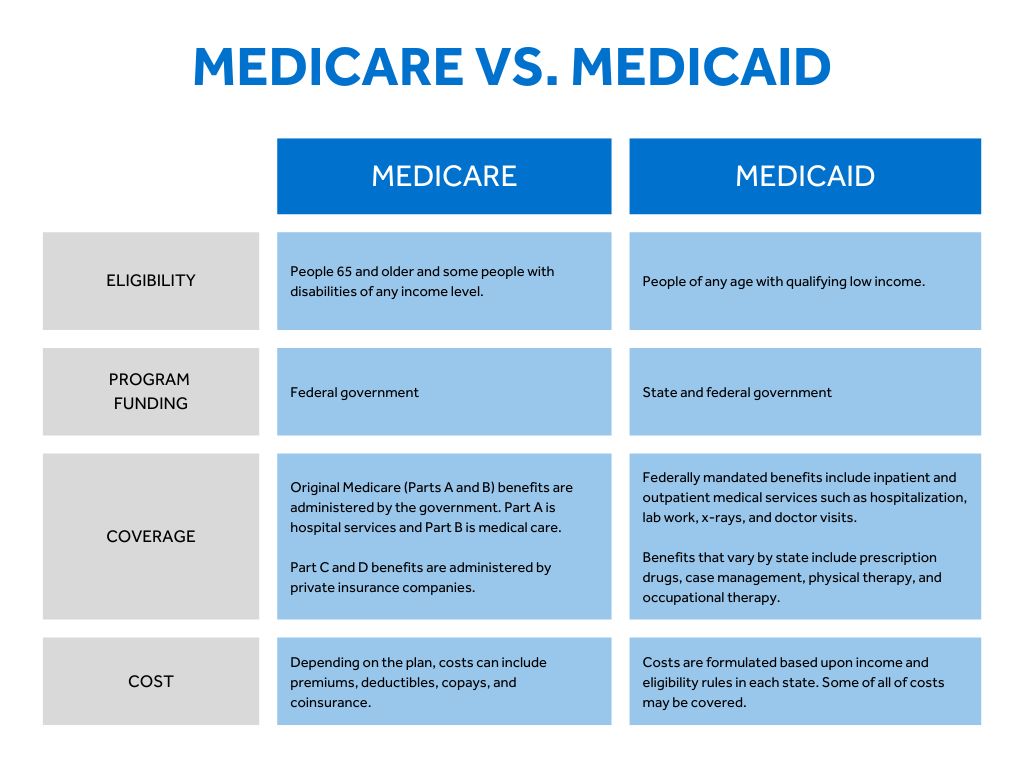

However, private long-term care insurance is out of reach for many due to expensive premiums, and even though Medicare covers some skilled nursing care, it doesn’t help much for long-term stays. The answer for many is Medicaid, which covers 63% of long-term nursing home stays. But getting approved for Medicaid can be tricky, especially when it comes to the Medicaid Look-Back Period.

What is Medicaid and Who Does It Help?

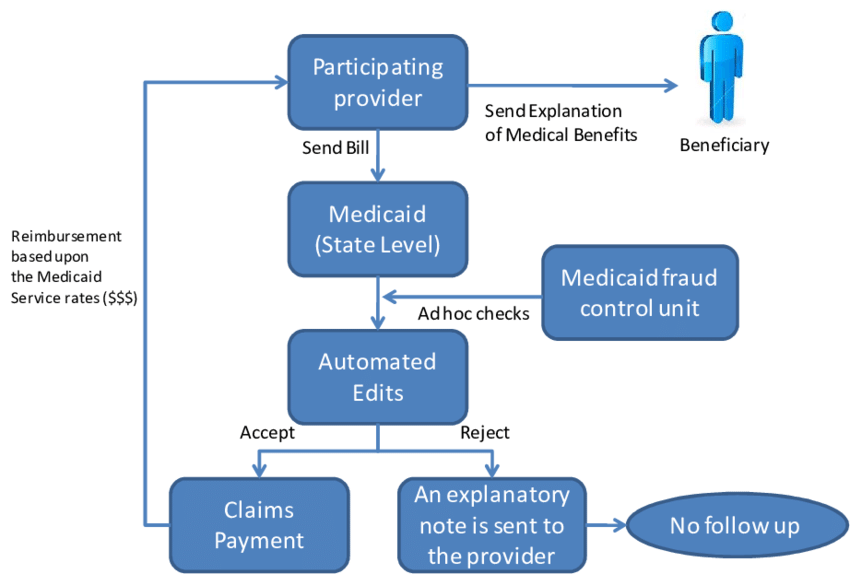

Medicaid is a government program that provides healthcare coverage to low-income individuals. To qualify, people must meet certain income and asset requirements. In the past, the qualification was based on how much money you made and what assets you had, but with the Affordable Care Act (ACA) in 2010, this changed for many applicants.

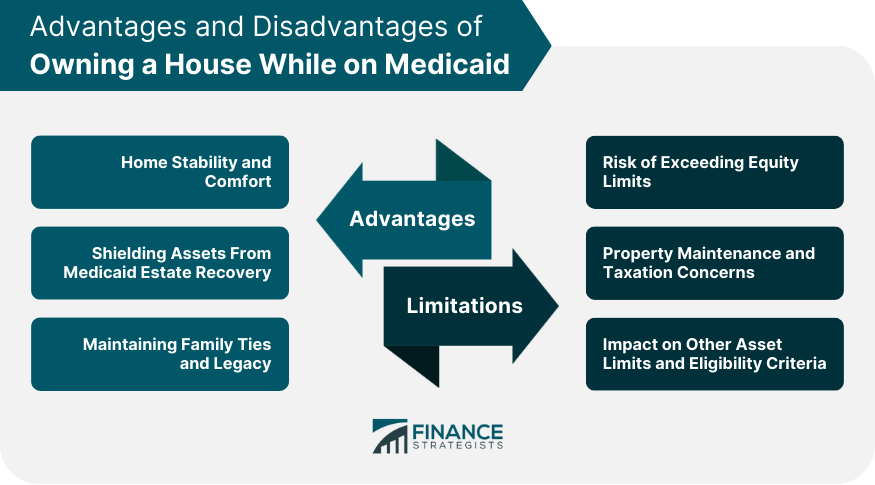

For people under 65, Medicaid eligibility is based on income, but for people 65 and older, as well as those with disabilities, eligibility still depends on both income and assets. This is especially important for people seeking Long-Term Services and Support (LTSS), which covers nursing home care. If you have significant assets, even if your income is low, Medicaid might not cover your care unless you meet the eligibility requirements.

What is the Medicaid Look-Back Period?

The Medicaid Look-Back Period is a rule that prevents people from transferring or gifting their assets just before applying for Medicaid to qualify for nursing home care. The idea is to stop individuals from giving away their wealth to relatives or selling their property for less than it’s worth in order to qualify for Medicaid benefits.

The Look-Back Period is typically 60 months (five years) in most states, though some states like California have a shorter 30-month Look-Back Period. During this time, Medicaid will examine your financial transactions to see if you’ve given away money, property, or assets for less than their fair market value. If you have, it could result in a penalty period where you are ineligible for Medicaid until the penalty is over.

How Does the Medicaid Look-Back Period Work?

If you apply for Medicaid for nursing home care, the state Medicaid agency will review your financial history for the past five years (or 30 months in California). If they find that you gave away money, property, or assets for less than their market value, this could delay your eligibility for Medicaid.

For example:

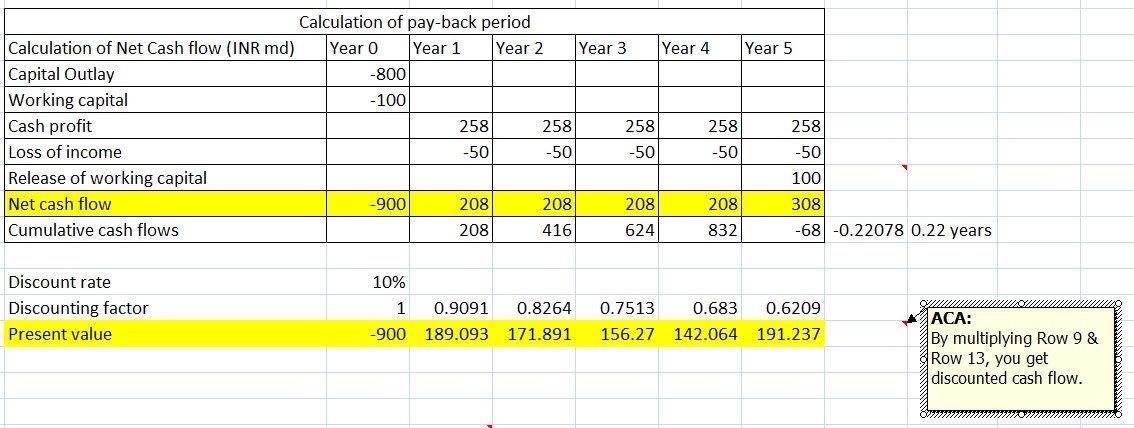

- If you give away $60,000 during the Look-Back Period, and the penalty divisor in your state is $6,000 (the average monthly cost of a nursing home), you would be ineligible for Medicaid for 10 months.

- If you sell your home to your daughter for $120,000 less than the fair market value within the Look-Back Period, you would face a penalty of 20 months without Medicaid coverage.

Irrevocable Trusts and the Medicaid Look-Back Period

Irrevocable trusts are commonly used by people trying to protect assets from Medicaid. These trusts are usually not counted as assets for Medicaid purposes. However, if the trust was created within the last five years, Medicaid will treat it as a gift, and it will fall under the Look-Back Period.

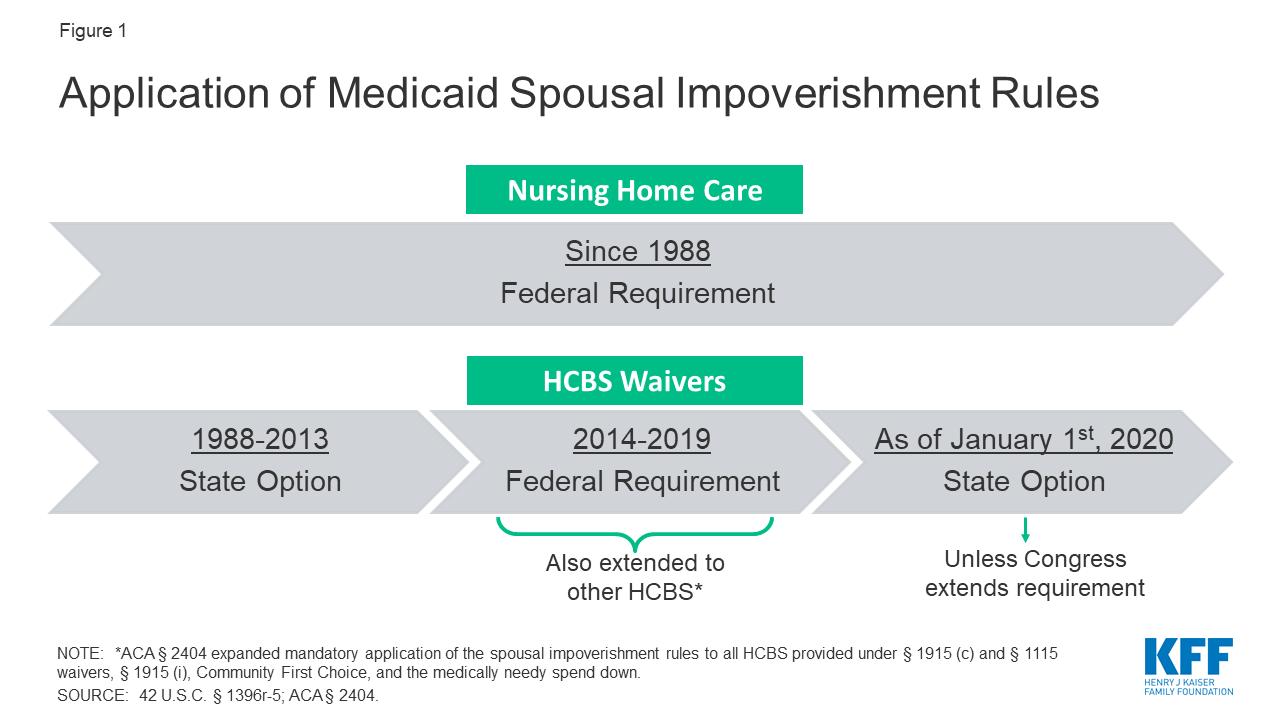

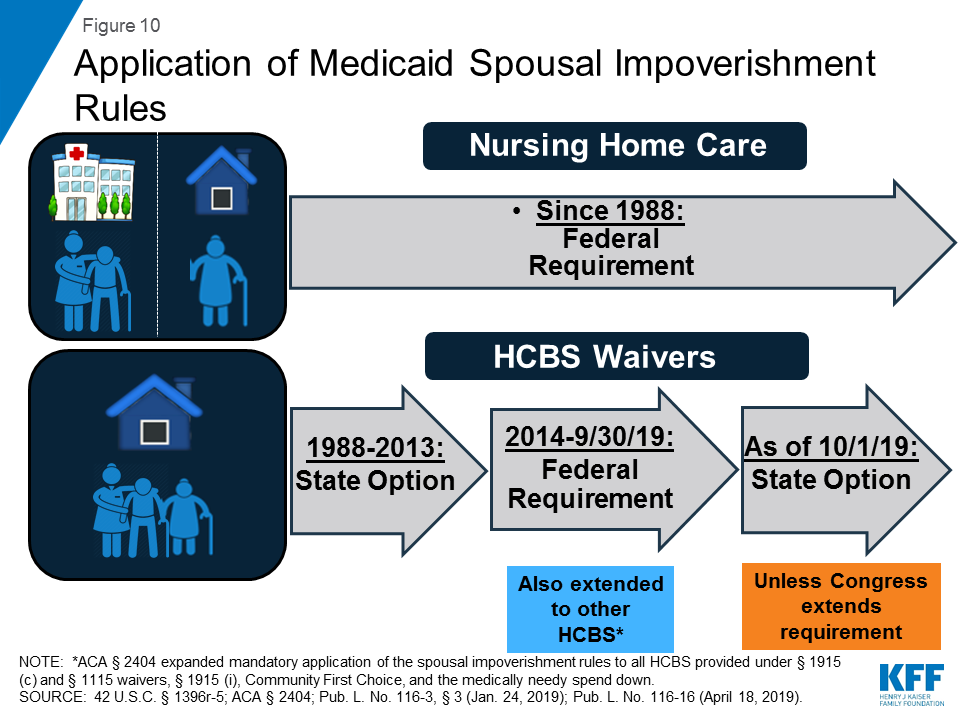

This rule also applies to spousal impoverishment provisions, which are designed to ensure that the spouse who remains at home has enough income and assets to live on. In 2025, the Minimum Monthly Maintenance Needs Allowance (MMMNA) for the spouse who remains in the community is set at $2,555. For Alaska and Hawaii, this amount is higher.

What Happens if You Violate the Look-Back Period?

If you violate the Medicaid Look-Back Period by transferring assets or giving gifts, you will face a penalty period. This penalty means that you will not be eligible for Medicaid for a certain period, which can be a significant problem if you need immediate nursing home care. The penalty is calculated based on the amount of assets transferred and the average cost of a nursing home in your state.

Example of the Look-Back Period Penalty Calculation

If the penalty divisor is $6,000 per month, and you transferred $60,000 in assets during the Look-Back Period, your penalty would be 10 months. That means you would have to wait 10 months from the time you applied for Medicaid before your application could be approved.

Strategies to Deal with Medicaid’s Look-Back Period

While it’s tempting to give away assets to qualify for Medicaid, the rules are strict, and penalties can be severe. If you’re thinking about applying for Medicaid for nursing home care, it’s essential to plan ahead. Here are some strategies to keep in mind:

- Start Planning Early: The best way to avoid problems with the Look-Back Period is to plan ahead. Start thinking about your future healthcare needs and how you’ll qualify for Medicaid well before you need nursing home care.

- Consult an Elder Care Attorney: An elder care attorney can help you navigate Medicaid rules and create a strategy that ensures you can receive care when you need it without risking penalties.

Conclusion: Planning for Medicaid and Nursing Home Care

Nursing home care can be incredibly expensive, and for many seniors, Medicaid is the only way to cover the costs. However, the Medicaid Look-Back Period can complicate the process if you’ve transferred or given away assets within the past five years. Understanding how this period works and how to properly plan for it is essential to ensuring that you can qualify for Medicaid and get the care you need.

Make sure to take proactive steps, consult an expert if needed, and ensure you’re not caught off guard by the Look-Back Period when the time comes to apply for Medicaid. Careful planning can help you get the care you need without financial penalties.

FAQs

Q: What is the Medicaid Look-Back Period?

A: The Medicaid Look-Back Period is a review of your financial transactions over the past five years (30 months in California). Medicaid checks for any assets transferred or given away below market value, and these actions can affect your eligibility.

Q: How long does the Medicaid Look-Back Period last?

A: In most states, the Look-Back Period is 60 months (five years), but in California, it is 30 months. Some states are also considering changes to the period, especially for in-home long-term care.

Q: What happens if I violate the Look-Back Period?

A: If Medicaid finds that you’ve given away assets during the Look-Back Period, you’ll face a penalty period. This means you may have to wait before you can be approved for Medicaid, and the length of the penalty depends on the amount you transferred.

Q: Can I protect my assets from Medicaid’s Look-Back Period?

A: While strategies like placing assets in an irrevocable trust are common, any trust set up within the Look-Back Period will be treated as a gift and may still count against your eligibility.

Q: How can I avoid penalties with Medicaid?

A: The best way to avoid penalties is to plan ahead and not transfer or give away assets within the Look-Back Period. Consulting an elder care attorney can help you navigate Medicaid rules effectively.

Q: Does Medicaid cover all nursing home costs?

A: Medicaid covers long-term care in nursing homes for eligible individuals, but only if you meet the income and asset requirements. Medicaid also has rules in place to prevent people from qualifying for coverage by transferring assets.

Conclusion: Navigating Medicaid and the Look-Back Period

Medicaid plays a crucial role in helping many Americans afford nursing home care, which can be prohibitively expensive. However, understanding the Medicaid Look-Back Period is essential for anyone planning to apply for Medicaid for long-term care. The Look-Back Period ensures that individuals don’t transfer or give away assets just before applying to avoid paying for their care. If assets are transferred or given away within the past five years (or 30 months in California), it can result in a penalty period that delays eligibility for Medicaid.

To avoid penalties and ensure you qualify for the care you need when the time comes, it’s vital to plan ahead. Early planning, proper asset management, and seeking guidance from an elder care attorney can help you navigate the complexities of Medicaid and the Look-Back Period. By taking proactive steps, you can ensure that you or your loved ones receive the necessary care without facing financial setbacks.

Ultimately, Medicaid is a lifeline for many seniors, but it’s important to be fully aware of the rules and requirements to avoid complications when applying.