Understanding Medical Underwriting in Insurance

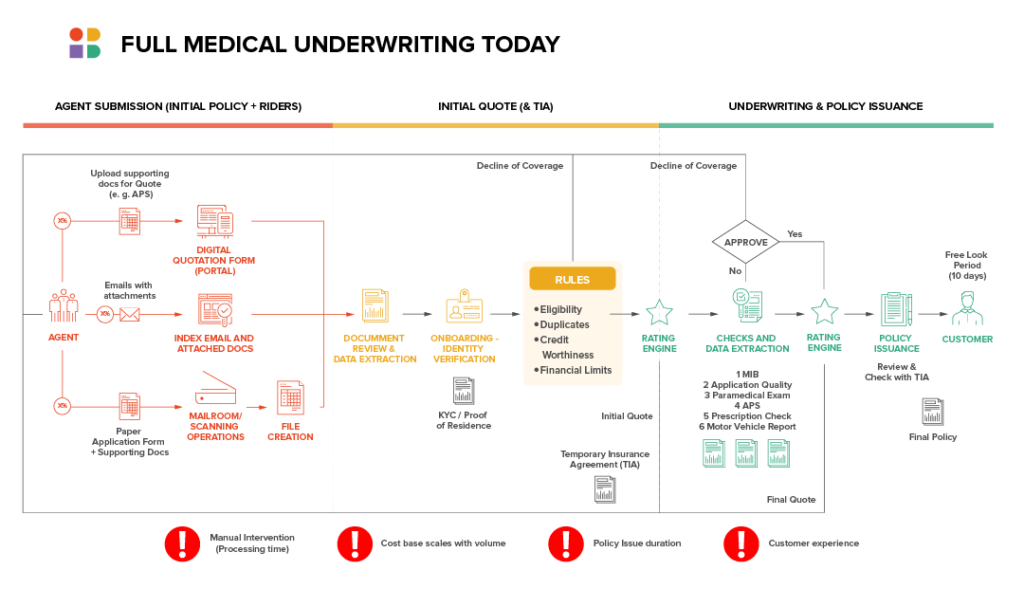

Medical underwriting is a process used by life, disability, and health insurers to determine whether an applicant qualifies for coverage, and what that coverage will look like in terms of premiums, exclusions, and conditions. This process involves using the applicant’s medical history to assess risk and ensure that the insurer is offering fair coverage while keeping premiums in check.

In simple terms, when you apply for insurance, the insurer looks at your medical records to figure out if you’re eligible for coverage, if there will be any exclusions for pre-existing conditions, and whether your premium will be higher than the standard rate.

Where Is Medical Underwriting Used?

Medical underwriting is typically used for policies where pre-existing conditions can affect the pricing or eligibility. While the Affordable Care Act (ACA) made significant changes to health insurance underwriting, life insurance and disability insurance (especially those purchased individually) still largely rely on this process.

Medical underwriting can apply to both individual and group coverage. However, the rules differ based on the type of plan:

- Individual Health Insurance: With the ACA’s implementation, insurers are prohibited from considering an applicant’s medical history when enrolling in individual or small-group health plans. The only exception is tobacco use, which can still impact premiums in most states.

- Group Insurance: For small group plans (typically for businesses with fewer than 50 employees), the group’s overall health history can no longer impact premiums, thanks to the ACA. For larger groups, premiums can be influenced by the group’s claims history.

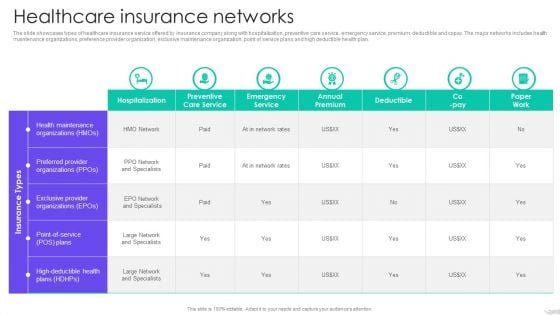

Types of Health Insurance and Medical Underwriting

- Major Medical Coverage:

- Thanks to the ACA, insurers cannot use medical underwriting to reject applicants or impose pre-existing condition exclusions for major medical coverage in the individual or small group market.

- Open enrollment or special enrollment periods apply, but insurers can no longer base decisions on your medical history.

- Small Group Health Insurance:

- Small groups can purchase coverage anytime, but employees can only enroll during specific periods (open or special enrollment).

- Insurers cannot consider an individual employee’s medical history when determining eligibility or premiums.

- Large Group Health Insurance:

- Large groups (usually businesses with over 50 employees) can see premiums based on their collective claims history. However, individual employees within the group cannot be charged different premiums based on their personal medical histories.

Insurance Types Using Medical Underwriting

While the ACA limits medical underwriting for major medical health insurance, it still applies in certain types of coverage:

- Excepted Benefits: These are health insurance plans that aren’t regulated by the ACA. They include:

- Dental/Vision Plans

- Accident Supplement Insurance

- Critical Illness Plans

- Short-Term Health Plans

- Life Insurance and Disability Insurance:

- When you apply for life or disability insurance, expect medical underwriting to be a part of the process. Insurers will check your medical history, and might even send a nurse to your home for a medical exam.

- If you’re applying for a higher coverage amount, be prepared for a more thorough underwriting process.

- Medicare and Medigap:

- While Medicare Advantage plans do not use medical underwriting, Medigap plans (supplemental insurance to Medicare) do. If you apply for Medigap coverage after the initial enrollment period, you may face medical underwriting.

- Some states have provisions for people to switch Medigap plans without underwriting, but this is not available everywhere.

- Short-Term Health Insurance:

- Short-term plans are usually medically underwritten. They tend to have fewer benefits and can exclude coverage for pre-existing conditions.

- Post-claims underwriting is common with these plans, meaning that after you apply, your medical history may be reviewed if you make a claim, and any pre-existing conditions may result in a claim denial.

What You Need to Know About Medical Underwriting

While medical underwriting is no longer used for most individual and small group health plans thanks to the ACA, it’s still common for other types of insurance, like life insurance, disability insurance, and short-term health plans. Insurers rely on this process to manage their risks and ensure that they can offer fair premiums and coverage.

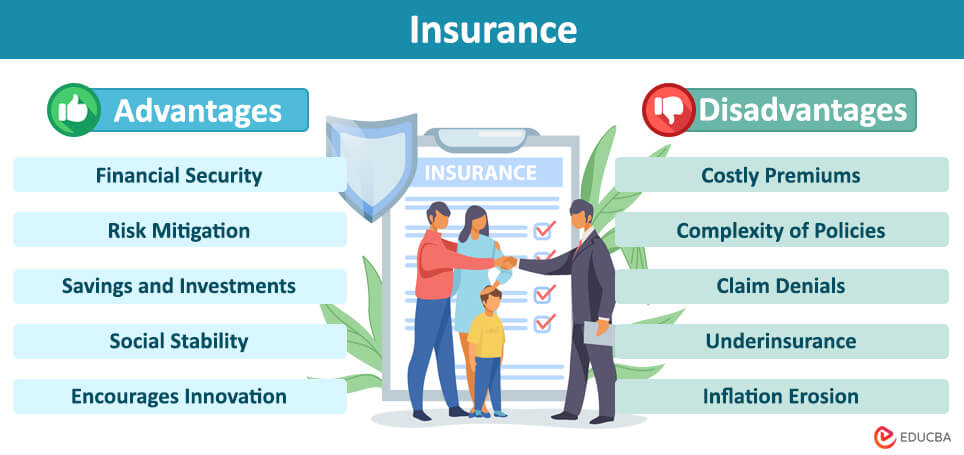

Advantages and Limitations of Medical Underwriting

Advantages:

- Helps Insurers Manage Risk: Medical underwriting allows insurers to assess the risk an applicant poses, making it easier to offer coverage and set premiums that match the risk.

- Prevents Fraud: By reviewing medical history, insurers can ensure that applicants are honest about their health status.

- Tailored Coverage: With underwriting, insurers can offer more personalized policies, making sure the coverage matches the applicant’s needs.

Limitations:

- Exclusions for Pre-existing Conditions: If you have a pre-existing condition, medical underwriting may result in higher premiums or the exclusion of that condition from coverage.

- Access Barriers: Some people, particularly those with chronic health conditions, might find it difficult to access coverage or may face exorbitant premiums.

- Post-Claims Underwriting: In some cases, insurers will review your medical records after a claim is filed. If they find pre-existing conditions related to the claim, they may deny coverage or cancel the policy.

FAQs

Q: Does the Affordable Care Act eliminate medical underwriting for all health insurance?

A: The ACA eliminates medical underwriting for individual and small group health insurance plans, ensuring that insurers cannot use your medical history to determine eligibility or premiums.

Q: Does medical underwriting apply to life insurance?

A: Yes, life insurance policies typically use medical underwriting. Insurers will review your medical history and may even require a medical exam to assess your risk.

Q: Are short-term health insurance plans subject to medical underwriting?

A: Yes, short-term health plans are medically underwritten, and they often exclude coverage for pre-existing conditions. Post-claims underwriting may also apply.

Q: Can I switch Medigap plans without medical underwriting?

A: In most states, you’ll need to go through medical underwriting to switch Medigap plans after your initial enrollment period. However, some states offer special opportunities to switch without underwriting.

Q: How does medical underwriting affect premiums?

A: Medical underwriting can result in higher premiums if you have a history of health conditions, as insurers may consider you a higher risk.

Q: Can insurers deny coverage based on medical underwriting?

A: Insurers can deny coverage based on medical underwriting in certain situations, such as if you have a pre-existing condition or if you apply for coverage outside of open enrollment periods.

Conclusion: Medical Underwriting in Insurance

Medical underwriting plays an important role in determining eligibility and pricing for various types of insurance policies. While major medical coverage is protected from underwriting thanks to the Affordable Care Act, many other types of coverage—including life insurance, disability insurance, and certain supplemental plans—still rely on this process. It’s important to understand how medical underwriting works, as it can affect your eligibility and premiums.

Before applying for any insurance policy that involves medical underwriting, make sure to review your medical history and understand how it might impact your eligibility and coverage. The rules are different for each type of plan, and knowing these nuances can help you make the best decision for your health and financial situation.